Clockwork News. |

|

At Clockwork Contracting Ltd, we are delighted to announce that we have become a member of the Umbrella Leaders Association (ULA). This marks an important milestone in our commitment to providing an excellent umbrella employment service to our clients.

The ULA is an independent, professional body that works to protect the interests of the self-employed and the umbrella sector. As a member, we have committed to adhering to their high standards of service and professionalism. This means that our clients can have complete confidence that we are providing a quality service. Being part of the ULA will also allow us to tap into a wealth of resources that help us to stay abreast of the ever-changing landscape of umbrella employment. This includes access to expert advice and support, as well as a network of fellow ULA members who can offer guidance and advice. We are proud to be part of the ULA and are excited about the opportunities this provides for our clients and our business. We look forward to continuing to provide a quality service and being part of the ULA family.

0 Comments

Lots of businesses are still unaware of the alternative options they have when it comes to payroll management. It is usually assumed that organising payroll internally, with one or a few people managing everything, is the most cost-effective approach for smaller and medium-sized companies.

But, in-house payroll can have numerous disadvantages such as hidden costs and long-term issues, which can affect a company's efficiency and profitability. For this reason, in this post, we will explore the costs involved in managing an in-house solution and outline why you might be better off outsourcing your payroll with a company such as Clockwork Contracting. What Makes In-House Payroll Management Expensive? When it comes to in-house payroll management, there can be a lot of hidden costs that aren’t always visible to businesses at a first glance. Organising your payroll is a complex, tricky skill and there is so much involved in it. It is not just about transferring wages to employees. Over a long period of time, in-house payroll management can lead to extra costs such as;

Compliance Issues As is to be expected, there is a lot of legislation surrounding employee payroll. When your business chooses to manage payroll internally, this will mean that you have to deal with a lot of compliance issues. Doing this can be highly time-consuming and demanding on company resources. It costs lots of money to stay on top of constantly changing laws both domestically and internationally. With an outsourced payroll solution, you won’t face these expenses as there will be full compliance with tax law changes, employment and wage laws, and pension auto enrolment amongst other regulations. The Long-Term Nature of Payroll Management Payroll management can become much more expensive over time, as it is a long-term investment for any business. If you are just beginning in business and you decide to manage your payroll internally, then it will be a long-term cost to your company’s revenue and labour resources. When you outsource your payroll, all of the stress and costs associated with payroll management will disappear, as you’ll have a dedicated service from a specialist 24/7. Trusted Payroll Company in Bromley Now that you know more about all of the costs associated with internal payroll management, if you are searching for a reputable payroll company in Bromley - Clockwork Contracting is the provider to choose. Outsourcing your payroll with us will eliminate all of the stresses, overheads and administrative burdens of doing it yourself. We provide a dedicated payroll manager who liaises directly with HMRC and/or pension providers on your behalf. If you’d like to find out more, then please do not hesitate to contact us today. You can reach us on 0203 0042 262 or email us at payroll@clockworkcontracting.co.uk and we’ll get back to you as soon as possible. Mini Umbrella Companies have been in the news this year, and in this post, we take a closer look at what to look out for when using one of these schemes within your supply chain. It is really important for all businesses to do regular due diligence checks to identify the risks of Mini Umbrella practice. HMRC recommends all businesses do so to remain safe. Keep reading to learn more about the warning signs to remember when it comes to Mini Umbrella Companies.

1. Who Pays the Workers? The first warning sign to look out for is; who pays the worker? Usually, with this type of payroll model, payments are made to workers via randomly named companies, and these regularly change, with no transparency of pay deductions provided. They also require the Recruitment Agency to often submit multiple Key Information Documents for the same worker. Likewise, there is little or no employers’ national insurance paid on the workers’ pay. This is seen by HMRC as tax fraud. Lastly, there can be no evidence of taxes paid by the agency or end client as there are several suppliers. 2. Random Company Names The second warning sign of Mini Umbrella Companies is unusual company names. Workers are normally paid and contracted through different limited companies with strange names. This is because Mini Umbrellas need payroll companies to have limited payroll payments that allow the use of employers’ NI allowance and a bit more above this. 3. Trading Address, Location and Business Activities Thirdly, lots of Mini Umbrella Companies are run from serviced offices, bulk mailbox offices or even offshore. The business type registered at Companies House commonly mismatches with the actual trading group that the workers belong to. 4. Foreign Business Directors Similarly, it is a frequent occurrence that many directors or shareholders are non-UK nationals, non resident and non-tax residents. The workers are unable to interact with them, as some cannot speak English. This makes them a non-compliant payroll solution. 5. Flat Rate VAT Moreover, a high proportion of Mini Umbrella Companies use flat rate VAT accounting to gain additional income without needing to have proper accounting records and systems. Flat rate schemes based on business type effectively increase the Mini Umbrella access to “created” VAT savings. As a result, this is why lots of them have the incorrect business classification at Companies House - it gives them bigger savings. This is a type of VAT fraud and it is an indicator of a noncompliant payroll solution. 6. Abuse of Employers’ Allowance A final warning sign is that Mini Umbrella Schemes are structured to provide several Employment Allowance opportunities through the use of multiple Limited companies. Searching for a Compliant Payroll Provider in the UK? As we touched on at the start of this post, it’s important to do due diligence as the costs of not doing so are very high. If you would like to protect your business, then it’s vital that you choose a compliant payroll solution such as Clockwork Contracting. We are a trusted payroll provider, offering compliant and transparent services to end clients, agencies and contractors. If you’d like to get in touch with us, then please contact us today on 0203 0042 262 or email us at payroll@clockworkcontracting.co.uk and we’ll get back to you as quickly as possible. Payslip skimming has been in the news recently, with stories of some of the UK’s leading umbrella companies engaging in the practice. If this is something you’ve heard of, but you don’t quite understand what it means, then this blog is for you.

In this post, we take a look at what payslip skimming is, and how you can avoid it. Keep reading to find out more, and if you’re looking for a reputable umbrella company, then visit the Clockwork Contracting website today. What is Payslip Skimming? Essentially, payslip skimming is when a company is not being fully transparent with its workers on the charges that it applies. For example, they’re marketing a charge to a worker, which most assume is the total cost to them for using that service, but at the same time, they’re applying hidden costs that effectively amount to a profit for the provider. Skimming is allowed to flourish in environments where there is a lack of transparency. Within the industry, there have been a number of umbrella companies who have been deliberately following this practice for a number of years. In essence, they are deducting an additional fee without it being displayed on the payslip. Many contractors don’t tend to look at their payslips, and so, they’re none the wiser and this practice can go on for many years. How Do I Avoid Payslip Skimming? The main way to avoid payslip skimming is to work with an umbrella company that is trustworthy, open and transparent at all times. This will give you reassurance that they are a provider with integrity and honesty. It is imperative that you find the right umbrella company to work with, and Clockwork Contracting is definitely the best choice for you. This is because we provide a range of umbrella company services in full compliance with the requirements and industry standards right now. Searching for Umbrella Companies in the UK? If you’re trying to find a trusted umbrella company in the UK, then Clockwork Contracting is the best choice for you. We are a leading provider of payroll and umbrella company services. We ensure that our services are fully compliant and transparent for all end clients, agencies and contractors. To find out more about our services, please give us a call on 02030 042262. You can also reach us by email at payroll@clockworkcontracting.co.uk or drop us a message via the online form on our website and we’ll be in touch with you shortly. We’re on hand to answer any questions you have and provide you with as much information as possible about our umbrella company services. Umbrella companies vs agency PAYE; what is the difference between them? Understanding the difference can be difficult, so we’ve written a short, helpful post that looks at some of the main differences to remember.

Read below to learn more about this, and if you are searching for an umbrella company, then Clockwork Contracting is the number one choice. We provide compliant and transparent services to end clients, agencies and contractors. Get in touch with us today via our website. What is an Umbrella Company? An umbrella company is a company that you become an employee of. This means that the agency will pay the umbrella company, who will deduct the necessary PAYE and NI contributions, before paying the contractor their salary. What is Agency PAYE? PAYE (Pay As You Earn) is when an agency is the contractor’s employer and is responsible for paying them. The agency must deduct the employed levels of tax and NI contributions are calculated, before the contractor receives their salary. What are the Main Differences? First of all, a big difference is that when an umbrella company is overseeing the necessary deductions, they will also be calculating the tax relief on any allowable business expenses, where the contractor isn’t subject to supervision, direction or control. As a result, this could mean that there is an increased take home pay. Contractors working through an umbrella company should submit their timesheets and log their expenses online. Secondly, another difference is the extra benefits you receive when working with an umbrella company. An umbrella company will give you access to certain statutory benefits such as sick pay. What’s more, they will also employ you under a contract of employment, so whether you carry out one assignment or 100, you will be employed under the same contract. This gives you a record of continuous employment, helping you with mortgage and loan applications. Furthermore, this will also ensure that you’re on the right tax code, whilst providing you with one pension pot too. There is also the benefit of an inclusive insurance package, which you won’t get if you’re to be paid via agency payroll. Searching for an Umbrella Company? Should you be searching for an umbrella company, then Clockwork Contracting is the best choice. We are a trusted payroll provider and umbrella company with an excellent reputation and customer service. We provide a number of services including PAYE Umbrella, Self-Employed, Professional Employment Organisation (PEO) and Outsourced Payroll. If you would like to get in touch with us at Clockwork Contracting, then please give us a call on 02030 042262. We’re here to answer your questions, provide you with more details about our services, and discuss your requirements in more depth. You can also message us via the online form on our website or email us at payroll@clockworkcontracting.co.uk and we’ll get back to you as quickly as possible. In the meantime, head over to the Clockwork Contracting website today for more information. What is an umbrella company? This is a really common question that we get asked, and a question that seems to be getting asked more and more often too. In this post, the team at Clockwork Contracting explores what an umbrella company is, and everything that you need to know.

Keep reading below to learn more, and if you would like to enquire about our services and how we can assist you with umbrella companies, then please contact us via the details at the bottom of this post. What is the Role of an Umbrella Company? Essentially, an umbrella company employs a worker who is on a fixed term contract assignment. What the umbrella company does is act as an intermediary between yourself - a contractor - and your end client or agency. The agency will pay the umbrella company, and then the umbrella company pays you, the contract worker, through PAYE, just as they would if you were a full-time employee. National Insurance and tax will be deducted by the umbrella company on your behalf. This is just a process that serves to simplify your administrative and financial responsibilities. You won’t need to worry about tax returns. Benefits of Umbrella Companies There are many benefits of umbrella companies; the biggest advantage being that they’ll get rid of your administrative burden and ensure that you’re paid on time every single time. You will get the benefits of permanent employment, whilst also maintaining the flexibility of part-time contracting too. Furthermore, you will also get statutory employment rights as soon as you join the umbrella company. This means that you will get holiday pay, sick pay and maternity/paternity pay too. In addition to this, you will also get HR support from a professional HR department, providing you with guidance and support when needed. In addition to this, umbrella companies are beneficial as they have years of experience in the industry, and can provide you with a trusted service that you can always rely on. There is nothing like the peace of mind that an umbrella company can provide you with. To find out more about the benefits of umbrella companies, contact the Clockwork Contracting team today. Leading Umbrella Company in London Here at Clockwork Contracting, we pride ourselves on being one of the leading umbrella companies in London, providing a leading service from start to finish. We provide a fully compliant and transparent service to our end clients, agencies and contractors. Our team provides expert support and keeps up to date with all the latest news, laws and policies. We provide assistance whenever you need us. To find out more about our East London umbrella company, please contact us today. You can reach us by phone on 0203 004 2262 or email us at payroll@clockworkcontracting.co.uk and we’ll get back to you as soon as possible. In the meantime, head over to our website to find out more about all of our umbrella company services in more depth. Want to reduce the headache of having to manage your own internal payroll system? Considering switching to an outsourced payroll system from a dedicated provider? There are many benefits to taking this step, and in the post below, the team at Clockwork Contracting takes a look at all of the associated advantages you can gain.

Read below to find out more, and if you would like to enquire about our payroll services, please contact us via the details at the bottom of this post. Will Save you Time First of all, when you outsource your payroll, it will save you huge amounts of time and energy. You will be able to focus this newfound time into other important areas of your business, such as growing your business through product development, sales and customer service. Overall, outsourcing will save you lots of time that can be better used elsewhere. Can Save you Money Another benefit of outsourcing your payroll is that it can provide you with financial savings too. Whilst of course you will be paying a fee to the payroll provider, when this is actually compared to the potential cost of fines and penalties from mistakes, it can actually be far more cost effective and financially sensible to use an outsourced payroll service. Helps Reduce Errors Payroll errors occur, it’s just a fact of life. However, these payroll errors can be avoided when you transition to a payroll provider. This is because many payroll providers automate aspects of payroll. As a result, what this means is that mistakes and errors can be reduced - most commonly, the ones that occur from manual data entry and calculations. Ensures Compliance Compliance is essential, and when you choose to outsource your payroll, you can better ensure compliance at all times. A payroll provider must stay up to date with all of the changing government regulations and legislation. Therefore, they will be compliant and ensure this across all of their activities. What this means is that you will not have to worry about compliance and completing lots of paperwork to do so. Searching For Payroll Providers in the UK? If you are looking for a trusted payroll provider, then Clockwork Contracting is the ideal choice for you. We provide outsourced payroll services, tailored to our clients’ individual needs and requirements. As part of our service, we can provide a payroll manager to liaise with HMRC directly, as well as pension providers, on your business’ behalf. It is all of the benefits of a streamlined payroll department, with none of the difficulties. We provide expert support and services, and are fully compliant and follow the latest legislation as needed in the industry. To enquire about our services, please contact us today. You can reach us by phone on 0203 004 2262 to speak with a member of our team. We can answer any questions or enquiries today. Alternatively, feel free to email us at payroll@clockworkcontracting.co.uk and we will get back to you as soon as possible. re to edit. So, May and its three bank holidays are now behind us. How is it that we’re almost halfway through the year already?! This month’s newsletter focuses on the government’s announcement that it has reversed its plan to withdraw almost 5,000 EU laws currently in force in the UK. Read on to understand how this decision has the potential to impact all of us. But first, a further update about meeting the P11D filing deadline on 6 July. Filing P11Ds when different agents deal with tax affairs I’ve mentioned in previous newsletters that since 6 April 2023, forms P11D (for reporting employee benefits) can now only be filed electronically, which is posing problems for some employers who don’t have much time to obtain payroll software to enable them to do this before the reporting deadline of 6 July. But there is another group of employers facing unexpected challenges because of this late change to the method of filing of P11Ds: it is not uncommon for employers to outsource their payroll to two different payroll agents, one company to deal with day to day payroll, and another to complete and submit the P11Ds and everything associated with them. Unfortunately HMRC’s systems do not currently have the functionality to allow an employer to have more than one agent working for them on the same head of duty, in this case PAYE. So where does that leave employers who find themselves in this position? The Institute of Chartered Accountants in England and Wales raised the issue with HMRC who advised that an agent can file P11Ds and P11D(b)s, including amendments, for an “unauthorised” client. They would need to add the client to their unauthorised client list in their Agent portal. Once they have done that, they are then able to file returns on behalf of the client. If the agent does not have log in credentials, which could well be the case if they have previously only filed paper returns, they will need to register themselves first, before being able to log in and then add a client to their unauthorised list. Another Brexit U-Turn?Doesn’t Brexit seem such a long time ago? With everything that has happened since, COVID and the war in Ukraine spring immediately to mind, it’s easy to forget that once upon a time we were all keen to know how Brexit would impact payroll, and indeed our lives in general, and that we haven't yet felt the full effect of our departure from the EU. The driving force for many Brexiteers was the desire to take control of our own laws, and the Retained EU Law (Revocation and Reform) Bill was therefore welcomed as the route to UK autonomy. The Bill contained a “sunset clause” which meant that any EU law, initially retained when we left the EU on 31 December 2020, would be automatically repealed at the end of 2023, unless it had been specifically preserved or replaced. However, there were many who had grave concerns that this “sunset clause” would have an adverse impact on employment law, and workers could lose access to long-established rights that currently form an integral part of Britain’s standing as a fair nation, such as holiday pay or protection against fire and rehire. It was not unexpected then that the news that the government has now decided to scrap the “sunset clause” from the Bill met with mixed reactions. Instead of the approximately 4,800 retained laws being discarded on 31 December this year, only around 600 pieces of retained EU law will be set out in a revocation schedule. Any laws not listed in the revocation schedule will be automatically retained. However, there are some key pieces of legislation affecting payroll and HR professionals, and indeed all of us, that the government is looking to change: Working Time Regulations 1998 (WTR)Holiday Entitlement:

Currently we are entitled to 5.6 weeks (28 days) annual leave each year. That is broken down in to two parts; four weeks that we are entitled to as a result of the EU Working Time Directive, and 1.6 weeks that come from the UK’s Working Time Regulations. The government plans to merge these two separate leave entitlements into one pot of statutory annual leave of 5.6 weeks. Whilst most employees won’t know or care about these different types of leave, this will bring a welcome simplification to payroll professionals. Rolled Up Holiday Pay: Despite the fact that rolled up holiday pay is illegal, and has been for some years, many employers still use this method of calculating and paying holiday pay, especially for workers with irregular working patterns. However, the outcome of the Brazel v Harpur Trust court case was to declare it unlawful to use the 12.07% method to calculate holiday entitlement, which is central to the calculation of rolled up holiday pay. The government now plans to introduce rolled up holiday pay into law, so some workers are able to receive holiday pay with every payslip, rather than when they take their holiday. This is done by adding money onto every hour of pay to represent the holiday pay, and then not paying the worker when they actually take leave. Now that we are no longer subject to EU law, the government is also consulting on its plan to allow the 12.07% calculation method, which would make it easier to calculate rolled up holiday pay should these reforms come in as proposed. Record Keeping Requirements: The UK’s WTR require employers to keep “adequate records” such as the maximum daily/weekly working time, including for night workers and young workers. But EU case law takes this much further than the WTR ruling that, in order to comply with the EU’s Working Time Directive, employers must also record the daily working hours for each worker. The government plans to remove this EU law, reducing the record keeping burden on employers. Employers will, however, still need to:

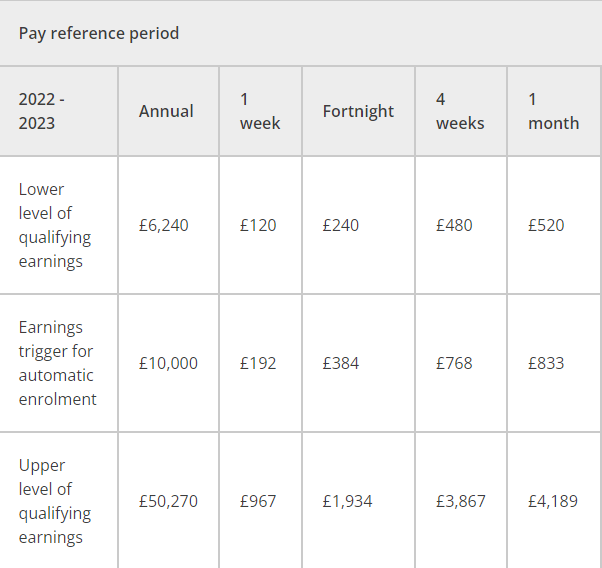

The government is consulting on an employer’s duty to consult in TUPE situations. Currently, employers must collectively consult with employees affected by a TUPE transfer via elected employee or union representatives. Individual consultation is only allowed for microbusinesses – ie. where a business employs 10 employees or less. The government plans to remove the requirement to consult with elected representatives for businesses with fewer than 50 people and transfers affecting less than 10 employees. This will reduce the need for many SMEs to elect representatives in TUPE situations, but may mean they have to complete more individual consultations. Restriction of Non-Compete Clauses The government has also proposed a new law to limit the length of non-compete clauses to three months. A non-compete clause is a section in the contract which prevents a departing employee from working for a similar or competing business. In a press statement, the Department for Work and Pensions (DWP) celebrated ten years of automatic enrolment (AE). Since this transformational policy was implemented, over ten million employees have contributed to their workplace pension. At the end of the statement, the DWP discusses future plans, including pension dashboards and midlife MOT's Also confirmed, is that the government is exploring abolishing the Lower Earnings Limit for contributions and reducing the eligible age to 18. These plans have previously been discussed in a private members bill, but confirmation of the DWP actively taking interest is promising for its success. Automatic enrolment earnings thresholdCurrently anyone under 21 working in the UK are classed as Non-eligible jobholders - meaning they are not enrolled into a workplace pension scheme. If they are still with their current employer when they reach their 22nd birthday they will opt-in to their workplace pension scheme.

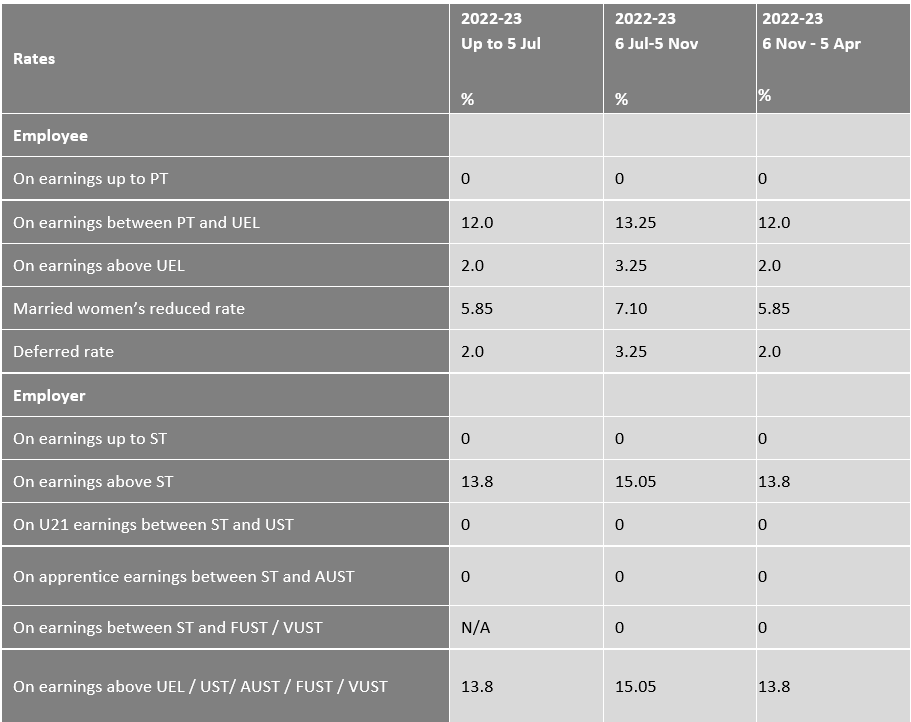

With the proposed change anyone employed over 18+ will be enrolled into a pension scheme and both the employee and employer would have to contribute. We will keep an eye out of any changes prior to the published article.  A Chancellor must present a Budget accompanied by independent economic forecasts prepared by the Office for Budget Responsibility. In place of a Budget, Chancellor Kwasi Kwarteng delivered a fiscal statement on 23 September, which means OBR assessments of the economy will have to wait until later in the financial year. Despite not being a full-scale Budget, there was still a lot of significant changes announced that needed to be understood and implemented. National Insurance rates reduced from 6 November 2022 In March this year the previous Chancellor, Rishi Sunak, announced that National Insurance rates would increase by 1.25% from 6 July, a temporary measure ahead of the introduction of a Health and Social Care Levy in April 2023. Payroll departments and software developers had three months in which to prepare for the increased rates. National Insurance rates were reduced by 1.25% for the remainder of the tax year, though the reduction cannot be backdated. The current Chancellor reversed the increase for the remainder of the tax year on 23 September. Six weeks from now, this reduction will take effect on 6 November. Some employers may not be able to make these changes in time, so refunds may be required. HMRC had previously asked software developers and employers to include a temporary generic message on payslips for the tax year 2022-2023 to explain the reason for the increased NICs. This message will not be applicable from 6 November 2022 and employers should now remove it from payslips. The Health and Social Care Levy, which was scheduled to come in April 2023, has been scrapped. The Class 1 NIC rates for 2022-23 are now as follows: Changes to income tax rates from 6 April 2023 The National Insurance changes had been widely predicted for some time, but changes to income tax came as more of a surprise. Kwasi Kwarteng brought forward by 12 months a planned reduction in the basic rate of income tax from 20% to 19% from 6 April 2023. In addition, he also announced that from the same date the additional rate of income tax of 45% for those earning above £150,000 will be abolished. This means that all annual income above £50,270 will be taxed at 40%, the current higher rate of income tax. These tax cuts apply in England, Wales and Northern Ireland. Scotland sets its own rates so is not affected. Off-payroll working rules repealed The Chancellor didn’t only restrict himself to announcing monetary changes, he also announced changes which the government believes will remove, or at least ease, administrative burdens on businesses, therefore boosting economic growth. And one of these announcements will have a significant impact on many payroll and HR departments, as we now know that the changes to the off-payroll working rules, introduced in the public sector in 2017 and extended to medium and large-sized organisations in the private and voluntary sectors in 2021, will be reversed. This means in practice that from 6 April 2023, workers providing their services via an intermediary will, once again, be responsible for determining their own employment status and paying the correct amount of income tax and National Insurance contributions. Possible employment law changes on the horizon It was only one sentence in the Chancellor’s statement, and his mention of “sunsetting” EU regulations by December 2023 may have been overlooked by those focussing solely on the tax cuts. It doesn’t have the catchiest of titles but the Retained EU Law (Revocation and Reform) Bill which was published on 22 September has the potential to impact everybody in the UK. When we left the EU, legislation was passed which incorporated EU law into UK law. This Bill aims to overturn that, allowing the UK government to make its own legislation. And let’s be honest, that was one of the main drivers for people voting for Brexit. But there is concern in some quarters that the reduction of burdens on business to improve growth may lead to the removal or relaxation of some employment rights such as:

|

AuthorJack Chinnery - Head of Payroll Archives

February 2024

Categories |

RSS Feed

RSS Feed