YOUR TAX CODE.

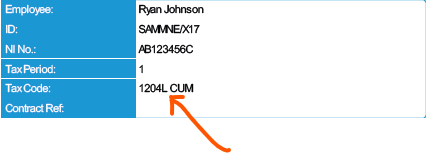

In the UK, every person paid under the PAYE scheme is allocated a tax code by HM Revenue and Customs. This is usually in the form of a number followed by a letter suffix, though other 'non-standard' codes are also used. This code describes to employers how much tax to deduct from an employee

The personal allowance is the amount a UK taxpayer can earn tax free. For the tax year 2022/23 the personal allowance increases to £12,570.

HMRC convert the personal allowance of £12,570 and turn it into tax code 1257L. They drop the last digit which gives 1257. The letter L is then added if you are entitled to the standard personal allowance. This therefore results in tax code 1257L.

Therefore if you have a tax code 1257L it means that you can earn £12,570 before you pay tax.

How Much Tax You Will Pay With Tax Code 1257L?

With a tax code 1257L your tax free total is £12,570 per annum. This is spread over the course of the year so that your weekly allowance would be £241. If paid monthly it would be £1,047.

Earnings in excess of this are taxed at 20%. This is for earnings between £12,571 and £50,270.

After this it increases to 40% for earnings between £50,271 and £150,000.

Earnings over £150,001 are then taxed at the highest rate which is 45%.

HMRC convert the personal allowance of £12,570 and turn it into tax code 1257L. They drop the last digit which gives 1257. The letter L is then added if you are entitled to the standard personal allowance. This therefore results in tax code 1257L.

Therefore if you have a tax code 1257L it means that you can earn £12,570 before you pay tax.

How Much Tax You Will Pay With Tax Code 1257L?

With a tax code 1257L your tax free total is £12,570 per annum. This is spread over the course of the year so that your weekly allowance would be £241. If paid monthly it would be £1,047.

Earnings in excess of this are taxed at 20%. This is for earnings between £12,571 and £50,270.

After this it increases to 40% for earnings between £50,271 and £150,000.

Earnings over £150,001 are then taxed at the highest rate which is 45%.

clockwork take home pay calculator.

Put in your tax code in our calculator to see how much tax you will be deducted.

Interactive tax code assistance tool released.

Individuals receive change of tax code notices for many reasons. These reasons may not always be known by the employer, making advice and guidance difficult to offer.

These reasons can be:

To assist individuals in accessing the correct information, based on their needs and situation, HM Revenue and Customs (HMRC) has released an interactive tool. The ‘get help understanding your tax code tool’ will help the user understand the reasons for the change and what next steps can be taken.

Check out the tool here.

These reasons can be:

- You start to get income from additional job or pension

- We (the employer) tells us (HMRC) you have started or stopped getting benefits from their job

- You get taxable state benefits

- You claim marriage allowance

- You claim expenses they get tax relief on.

To assist individuals in accessing the correct information, based on their needs and situation, HM Revenue and Customs (HMRC) has released an interactive tool. The ‘get help understanding your tax code tool’ will help the user understand the reasons for the change and what next steps can be taken.

Check out the tool here.

Now you can better navigate your Clockwork Payslip, you are a big step closer to working smoothly through us. But for anything that crops up on your payslip which we didn’t cover, or that you still want to understand about umbrella company operations generally, reach out to us via 0203-004-2262 or on our Contact us page so your query will be put forward to us.